Altrix Edge V9:

Altrix Edge V9 and Its Unique Learning Model

Sign up now

Sign up now

Starting the path toward investment education often feels overwhelming. Information is abundant, yet direction is scarce. Education provides the framework that converts scattered interest into coherent understanding. Instead of rushing toward conclusions, it organizes ideas so clarity can form over time.

Many individuals spend weeks or months reading articles, watching videos, or following online conversations. The flow of content never stops, but meaningful insight may still feel out of reach. Investment education helps align this effort, linking related concepts and revealing repeating themes. The focus remains on relationships and context, not on delivering instant solutions.

This usually occurs when material lacks structure. Without an organizing framework, progress feels circular, and learning becomes fragmented rather than purposeful.

Learning typically begins with essential building blocks. Foundational concepts appear first, followed by past market illustrations, and later by insights into behavioral tendencies across time. Progress is deliberate and unhurried. Rather than steering toward fixed conclusions, the process promotes careful reflection. Curiosity takes the place of presumption, and evaluation replaces guesswork. No single concept is elevated above others, and no destination is implied. Emphasis remains on approach rather than outcome. This measured progression allows insight to form naturally, without urgency or strain.

Investment learning reshapes awareness long before it guides choices. Responses become more measured, interpretation grows more precise, and inquiry gains direction. Past market moments continue to matter, complemented by instruments like visual data and recurring sequences. Education weaves these aspects into a broader lens. Dialogue with experienced educators prior to action encourages steadiness and restraint. Although education cannot eliminate unpredictability, it strengthens the ability to navigate it thoughtfully. Losses remain possible, particularly within highly volatile areas such as cryptocurrency markets.

Altrix Edge V9 is designed to introduce people seeking investment education to independent teaching providers. It does not interpret market activity or outline study routes. Its only role is to open a line of contact. From that point forward, conversations evolve collaboratively between the learner and the educator. This defined boundary keeps expectations clear and prevents misunderstanding. Entry is facilitated, while insight is built through independent learning.

Built around impartiality, Altrix Edge V9 refrains from expressing viewpoints, publishing learning material, or shaping discussions. The sign up step requests only essential contact details name, email, and phone number to establish an introduction. After this point, the site disengages. This separation safeguards independent judgment and ensures educational conversations remain uninfluenced. Learning stays individual, and all decisions remain the learner’s responsibility. Cryptocurrency markets are unpredictable, and losses are possible.

The registration process consists of a brief form created for a single function: noting interest in investment education and sharing that interest with independent education providers. No guidance, teaching, or explanations are given during this step. Its sole purpose is to begin communication.

After submission, the information is forwarded to independent education organizations. These providers may contact you to explain their educational approaches, subject areas, and scheduling options. No provider is prioritized, and no filtering occurs. Interaction develops organically through direct conversation rather than automated systems.

Registration does not guide decisions, reduce risk, or offer suggestions. It does not resolve uncertainty. Learning develops through ongoing inquiry, thoughtful review, and comparison across time. Considering multiple perspectives supports deeper comprehension. Once contact is established, full responsibility for choices rests solely with the individual.

Altrix Edge V9 supports individuals by introducing them to independent education organizations that focus on investment learning. The site itself does not teach or store educational content. Its role is limited to opening lines of communication so learning conversations can begin. Education reached through these connections concentrates on explaining market behavior, rather than giving instructions or promoting actions. Discussions often explore how markets develop over time, including themes such as cycles, historical context, participant activity, and changing reactions across different environments. The objective is to clarify and inform, without proposing decisions or results.

Education that develops through these connections often starts with broad, conceptual themes. Instructors discuss how price perception forms, what causes periods of strong movement to weaken, and how shared attitudes can influence overall direction.

Another major focus is behavior. Educators analyze how emotions such as caution, optimism, and attention shift during various market phases. These reactions tend to recur over extended periods and are illustrated through charts and timelines. The aim is to increase awareness, allowing learners to notice recurring market patterns rather than trying to forecast future movement. Results remain uncertain, and no assurances are offered.

Educational discussions also highlight the constraints of market activity. Markets do not always behave rationally, and unforeseen events can disrupt trends. Educators clarify why unpredictability is unavoidable and why recognizing risk is a core element of investment education.

Educational interactions often promote revisiting earlier decisions and weighing different perspectives. These reflections typically happen after volatile periods have settled, rather than during heightened activity. This approach encourages more durable, long term understanding of how markets evolve over time.

Financial learning shows that trading arenas operate as connected ecosystems rather than separate parts. Shifts in price often correspond with levels of participation, collective sentiment, and trading activity, with these elements commonly moving together.

Market environments usually pass through stretches of calm, periods of expansion, and phases of slowing momentum. Looking back across different historical eras reveals that these sequences appear again and again, even though their forms are never exactly the same. Educational discussion emphasizes observing the quieter stages, especially those that come before renewed movement.

It is similar to understanding music by valuing pauses as much as notes. This mindset supports composed observation and helps frame short lived price changes within a broader, more coherent perspective.

Altrix Edge V9 offers a structured starting point that helps individuals move from fragmented material toward clearer comprehension. With constant streams of commentary, graphics, and opinions appearing every day, many find it difficult to maintain focus. Learning conversations introduced through the site help filter this excess by prioritizing meaning and context rather than commands or signals.

The intention is to encourage thoughtful understanding, not immediate reaction. The site is designed to support analysis and reflection instead of issuing directions or definitive conclusions.

Clearly defined learning boundaries help prevent confusion. Insights shared through connected educators aim to clarify ideas rather than influence decisions. After contact is established, instructors discuss core principles, historical background, and repeated behavioral patterns. Progress follows an individual rhythm, grounded in realistic expectations and without fixed outcomes.

A structured approach allows learners to arrange information coherently instead of responding to every new update. A simple registration requesting only a name, email, and phone number opens communication. From there, informed discussion replaces assumption, allowing attention to remain on understanding rather than urgency.

Clarity develops most effectively without external influence. The site does not publish viewpoints or educational resources. Once introductions occur, dialogue is guided entirely by the learner and the educator. This distance safeguards independence and ensures decisions remain fully self directed.

Education does not eliminate uncertainty or prevent errors. It increases awareness. Independent research continues to play a central role, and questions naturally become more precise over time. Comparing differing perspectives supports balance, while conversations with qualified financial professionals add depth before decisions are made. Markets remain unpredictable, and digital assets carry elevated volatility with potential losses.

Establishing realistic expectations is essential. Altrix Edge V9 provides access to learning pathways rather than immediate solutions. It connects individuals with independent organizations focused on financial education.

The insight shared through these connections emphasizes context and explanation, not instruction or anticipated results. Uncertainty is a constant in financial markets, and the pronounced volatility of cryptocurrency means losses are possible.

Ongoing learning, paired with guidance from experienced financial professionals, supports careful consideration before any investment related actions are taken.

Altrix Edge V9 does not limit risk, anticipate results, or influence financial choices. It delivers no programs, notifications, opinions, or recommendations. At no point does it guide action. Its single purpose is to enable introductions, leaving evaluation, judgment, and accountability solely with the individual.

Market movement rarely presents obvious meaning. Long stretches of calm may come before activity, or shifts may occur without lasting significance. Educational conversations reached through these connections demonstrate why patience supports clearer insight. Emphasis remains on careful review rather than conclusions formed from brief price motion.

Registering with Altrix Edge V9 simply enables contact with independent education providers. The site does not participate beyond that point. All dialogue proceeds independently, without urgency, influence, or implied direction.

A typical entry point into financial learning is understanding how markets are structured and function. Education examines how values develop, what contributes to momentum or slowdown, and how shared sentiment affects participation. These factors help explain why markets move in repeating stages rather than predictable lines. Structural awareness allows short term movement to be viewed within a wider setting instead of as isolated change.

Managing uncertainty is a core element of investment education. Markets cannot be controlled and results are never guaranteed. Learning highlights constraints and exposure instead of assurances. Participants are encouraged to review varied viewpoints and continue independent analysis. Consultation with qualified financial professionals helps refine understanding before any action is taken. Digital asset markets are particularly unstable, and losses are possible.

The role of Altrix Edge V9 is defined by strict limits. The site does not teach, interpret, or supply educational material. Its only responsibility is to introduce individuals to independent organizations that engage in investment learning discussions.

By maintaining a narrow scope, the site avoids misunderstanding and allows visitors to quickly recognize what it does and does not offer.

Ease shapes the onboarding experience. Only essential contact details are requested, including name, email, and phone number. These details allow education providers to initiate direct contact. No additional selections, preferences, or filters are included. Reducing steps minimizes friction and keeps attention on conversation rather than process.

Altrix Edge V9 remains impartial throughout. No opinions, prompts, or highlighted viewpoints appear on the site. After an introduction is made, the site steps away completely. Education providers share their perspectives independently, allowing discussions to develop without framing or directional influence.

Once communication begins, responsibility for learning shifts entirely to the individual. Progress continues through personal research, discussion, and comparison of ideas. Questions emerge gradually as understanding deepens. Engaging experienced financial professionals helps assess insight before decisions are considered. Cryptocurrency markets remain highly unpredictable, and losses may occur.

Defined limits support trust. Altrix Edge V9 does not manage expectations or suggest results. After introductions are completed, the site remains uninvolved. Learning stays personal, and decisions remain individual. This transparency allows engagement to continue without hidden pressure or influence.

Defined responsibilities reinforce effective learning. Instructors share concepts, background, and patterns they observe without directing choices. Learners assess information independently, ask their own questions, and decide what is meaningful to them.

This separation reduces confusion, keeps expectations realistic, and lets curiosity shape progress, while accountability remains clear, balanced, and uncompromised.

Altrix Edge V9 functions as an entry point for those exploring financial education. It links individuals with independent education providers that host investment focused discussions. The site does not create lessons, describe methods, or outline market approaches. Its role ends after making the introduction, allowing learning to develop independently through direct and ongoing conversation.

Education does not control outcomes or eliminate uncertainty in financial markets. Conditions evolve, prices fluctuate, and participant behavior changes over time. Learning improves perspective by examining how timing and reactions influence interpretation across different phases. It offers understanding without assurances. Cryptocurrency markets are highly volatile, and losses may occur.

Maintaining clear boundaries supports transparency. Altrix Edge V9 limits its role strictly to creating connections. Independent educators manage explanations and discussions once contact is established. This structure avoids shaping expectations, safeguards independent thinking, and allows learning exchanges to remain flexible, personal, and guided by individual exploration.

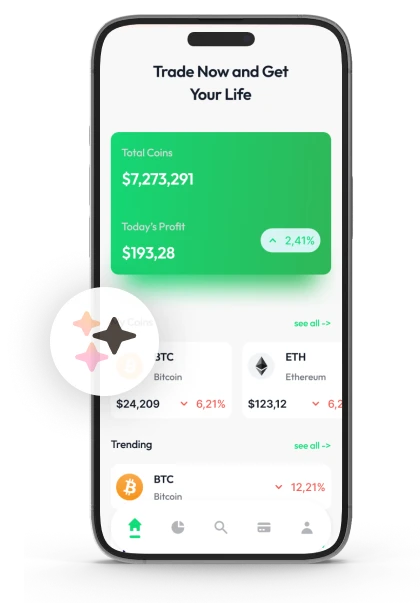

| 🤖 Enrollment Cost | Free of charge enrollment |

| 💰 Transaction Fees | No transaction fees |

| 📋 SignUp Procedure | Efficient and prompt registration |

| 📊 Curriculum Focus | Courses on Cryptocurrencies, the Forex Market, and Other Investment Vehicles |

| 🌎 Accessible Regions | Excludes USA, available in most other regions |